How Financial Need Is Determined

The expected family contribution, or EFC, is the amount of money that a family is expected to contribute toward the price of the student's education from its income and assets. There is a different need analysis formula for each of three student groups:

- Dependent students

- Independent students with no dependents

- Independent students with dependents

The EFC consists of two parts: the parent contribution and the student contribution. Generally, "family contribution" refers to both of these combined. For independent students, there is no parent contribution.

Available Assets

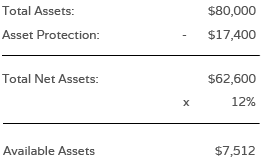

Assets usually are excluded from the EFC calculation for those with an adjusted gross income below $50,000. When assets are taken into account, the EFC formula provides an asset protection allowance according to age and marital status. The typical family receives an asset protection allowance of $17,400. This amount is subtracted from the parents' total net worth of assets and, of the remainder, only 12 percent is considered available assets for education expenses. Independent students with children receive the asset protection allowance, but the assessment rate is now 7 percent.

Example: Treatment of Parental Assets

In comparison, dependent students and independent students with no dependents are expected to contribute 20 percent of their total assets, since it is assumed that these students have saved their money for the purpose of paying for their education.

Assets used to calculate the EFC include:

- Real estate other than the family residence

- Investments

- Family-owned business with more than 100 employees

- A farm that the family does not live on

- Current cash, savings, and checking accounts

- Education IRA or higher education savings plans

The following assets are not included:

- The value of IRAs and other retirement plans

- Home equity (the difference between home value and home debt)

- Farm equity for a farm on which the family lives (the difference between the value of the farm and the debt against the farm)

- Family-owned business with fewer than 100 employees

- Cash value of life insurance policies

Available Income

To determine the amount of income available for educational purposes, both parents and students are given "offsets" against income. Offset include taxes (federal, state, local, FICA), employment expenses, and an income protection allowance. For parents and independent students with dependents, the income protection allowance can range from approximately $17,000 to $53,000, based on family size and number of family members enrolled in college.

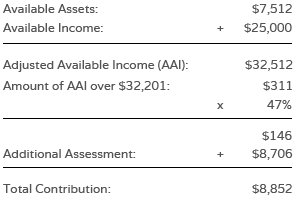

After subtracting the offsets from total income, the remaining income is called available income. For parents and independent students with dependents, the available assets are added to the available income to arrive at the adjusted available income (AAI). A portion of this amount is multiplied by 22 to 47 percent (plus a additional predetermined assessment) to arrive at the total contribution. The higher the income, the higher the percentage used.

Example: Parents or Independent Student with Dependents

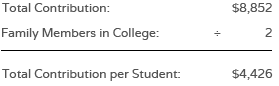

If more than one child attends college, the total contribution is divided by the number in college:

Example

Dependent students and independent students without dependents are expected to contribute 50 percent of their available income and receive a more limited income protection allowance:

- $6,400 for dependent students

- $9,960 for single independent students

- $9,960 for married independent students with both enrolled

- $15,960 for married independent students with one enrolled

Income used to calculate the EFC includes:

- Adjusted gross income, if tax filers, or total wages

- Non-taxable income, contributions to tax-deferred pension and savings plans, IRA deductions, child support, untaxed portions of retirement distributions and other items listed on the financial aid application

The following income is not included:

- TANF, untaxed Social Security benefits or earned income credits

- Food stamps or subsidized housing

- Student financial aid awards, including need-based work study earnings

- Federal education tax credits

- Child support paid to another household

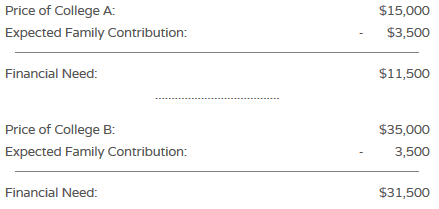

EFC & Financial Aid Need

The greater the financial need, the greater the student's financial aid eligibility.

A family's EFC remains the same even when the price of the school increases:

In this way, financial aid allows families to consider schools that would otherwise be out of reach. Estimate your financial aid eligibility for the Federal Pell Grant, Minnesota State Grant, and federal education tax benefits.

Quick Links

- Why College?

- Explore Your Interests & Careers

- Prepare at School

- Summer Academic Enrichment Program

- Earn College Credit in High School

- Recommended High School Classes & Graduation Requirements

- Advice for Students with Disabilities

- Succeed as an Adult Student

- Useful College Prep Resources

- Minnesota Goes to College!

- Get Ready Program Overview

- College Planning Presentation Information

- College Navigator Presentation Request Form

- Minnesota Indian Scholarship Program Outreach

- Competitive Grant Programs

- Dual Training Grant

- Public Engagement Calls

- "Life After Now" Podcast

- Certified Nursing Assistant Training

- Direct Admissions Minnesota

- Collecting Data from Minnesota Postsecondary Institutions

- Campus Financial Aid Administrator Resources

- Statewide Financial Aid Conference

- Campus Student Enrollment Reporting Resources

- Ordering Materials for Your Students

- Supplementing Your College Counseling

- Early Awareness Efforts

- Student Homelessness in Higher Education Resources

- Shared Library Resources

- MN FAFSA Tracker

- Campus Sexual Violence Prevention and Response

- Statewide FAFSA Filing Goal

- Financial Aid Estimator

- Online Applications

- About Financial Aid

- What Does College Cost?

- Tips for Lowering the Cost of Higher Education

- Institutional Payments

- Financial Aid You Don't Repay

- Financial Aid You Must Repay (Student Loans)

- Financial Aid You Earn

- Military Service Education Benefits

- Reduced Out-of-State Tuition Options

- Education Tax Benefits

- New Video Demystifies Paying for College

- Public Service Loan Forgiveness

- Useful Online Resources

- Ready, Set, FAFSA!

- Data Maps and Infographics

- Educational Attainment Goal 2025

- Minnesota Measures

- Minnesota P-20 Statewide Longitudinal Education Data System

- College Readiness & Participation Data

- Student Enrollment Data

- Degrees, Graduation Rates, Attainment & Outcomes

- Financial Aid Data & Trends

- Tuition & Fees Data

- Student Health and Safety

- Institution and Data Search

- Transfer Students

- Research Reports

- A-Z Data Table Index